A couple of weeks ago, I hosted a seminar in Vancouver to educate the locals about the real estate market in Toronto. I had the opportunity to speak with various seasoned real estate investors and agents. One thing always came up — the fact that the Vancouver real estate boom is coming to an end, and everyone is anticipating a decline in both real estate transactions and prices due to a few reasons:

1. Vancouver’s Heavy Reliance on the Chinese Capital

As I’ve mentioned in my previous blog, Vancouver’s economy has been heavily reliant on the investments of the Chinese. The Chinese economic growth has begun to slow down in the recent years, which means that we can anticipate its effects on other cities that rely on their investments.

2. The NDP Government’s Recent Imposition of Vacancy Tax & Foreign Buyers’ Tax

This has impeded the growth of Vancouver’s real estate market. Historically, Vancouver’s real estate markets have always been outperforming Toronto due to its proximity to Asia as well as its milder winters. This has always made it a very attractive location for wealthy investors abroad, who are the driving forces of the real estate market in Vancouver.

As technology has been advancing exponentially over the years, our large world has also been brought infinitely closer together. Information is available at the tip of our fingers and we have the opportunity to make more educated decisions (a luxury for all of us, really). This is especially useful for investors. Though some information online can be misleading, we know that investors (and everyone else!) are always using the internet to better inform themselves.

The strong interconnection between Toronto and Vancouver has begun to steer investors to Toronto as well. Now, Toronto’s market is beginning to look more appealing due to our diversity and our rapid advancements in the IT sector. Toronto is now considered the third largest populated IT hub within North America. Our job growths in the IT industry exceeds San Francisco and New York Combined. How crazy is that?

On top of that, Artificial Intelligence (AI) is now the biggest trend in the coming years — giving Toronto a huge edge in the investor’s market, with our growing IT sector. Corporations are flocking to set up offices in Toronto due to our lower costs and ease of hiring talent in Toronto.

Toronto is known for attracting more interprovincial immigration than any other city in Canada due to our employment opportunities and many prestigious schools are located in either the Golden Horseshoe area, which includes Toronto.

According to the CBRE Group:

“In a century when most developed countries will see their population decline, Canada will see population growth that continues to lead the G7. Toronto is forecast to account for 28% of this growth. Toronto’s favourable growth trajectory is underpinned by a diverse economy, ambitious infrastructure projects and the city being a destination of choice for international immigration.”

Source: https://www.cbreresidential.com/uk/sites/uk-residential/files/property-info/FINAL%20REPORT.pdf

On top of that, it is forecasted that Toronto population will increase by 25% in the year 2031, whereas the population will only increase by 12% in Vancouver.

When I mention that Toronto is becoming the new investor’s choice compared to Vancouver to people around me, many come up with similar points to counter my arguments, such as the following:

“Vancouver is unable to build as high as Toronto (Low Supply due to Earth Quake Zones) — therefore, prices of real estate in Vancouver will be higher.”

They are partially right. It is true that Toronto tends to build skyscrapers — but building skyscrapers are actually more expensive (per square footage built) than building a 20-storey building. The difference between Toronto and Vancouver is that our condos are lived up by the Millenials and people in the Middle Class income range.

Though over 50% of the new condo developments are for investments, the rent of a condo alone is enough to cover mortgage interest, maintenance fees and property taxes. Due to this fact, people who choose to invest in Toronto tend to have more power in terms of holding onto their property until they decide it’s a good time to sell.

“Toronto has far more land than Vancouver — making the land value in Vancouver higher.”

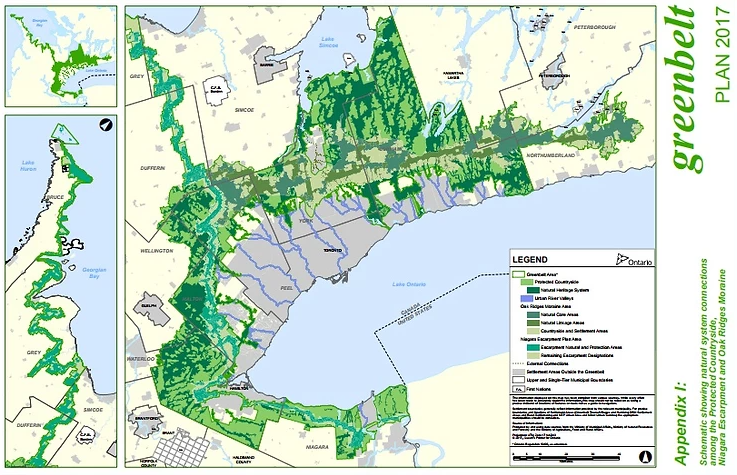

A slightly more amateur argument that I’ve heard. Yes, it’s true that we have lots of land. However, the government will not allow an urban sprawl to take place. Our government has all sorts of constraints for land developments, and a lot of our land is being classified as a “Green Belt Area” in Toronto. This is similar to how there is a lot of land in Surrey and the south of Richmond, but city planners prohibit developers from building there. Going back to one of the fundamentals I learnt in Geography in University, an urban sprawl is not feasible nor sustainable for human living.

In essence, a lot of investors (especially Chinese investors in Vancouver), are gravitating towards Toronto instead of Vancouver. Here are my summarized reasons why:

1. Toronto has a better and more diverse economy – and we all know the economy is always directly correlated with our real estate market.

2. Toronto has a higher population growth than Vancouver

3. Toronto offers a higher rental yield compared to Vancouver.

4. The Chinese investors in Vancouver do not have to pay the 15% NRST when they decide to invest in Toronto instead (as they are Canadian). This gives them an advantage in directing their investments from Vancouver to Toronto.

Do you agree? Leave a comment and let me know what you think!

Related Posts

2022 Toronto Real Estate Market Prediction

Happy New Year Everyone! Here is to hoping that 2022 treats us…

Real Estate Globally – A Comparative Analysis by Ringo Tsang

After taking a look at various cities globally for my family, I’ve…

Menkes年度C位大盘Festival Tower即将发售

新冠疫情令许多投资者hold住了买房的冲动,在疫情反复的当下,是现金为王、持币观望还是逢低买入,洼地捡漏,这道难题拦在了所有投资者的面前。让我们将目光拉回2003年的非典时期,疫情过后,北京等大中城市的房价抢高。以北京为例,疫情期间每平米不过万的均价,从2003年下半年就开始回温了,2004年上涨了6.7%,由此一骑绝尘,到5万+、10万+。事实上,疫情向来都不是长期打压楼市的力量,疫情后的报复性消费在房地产行业依然适用。抄底楼市的最好时机是什么时候?正是当下!正是基于对多伦多楼市的坚定信心,更是由于对旺市新区,尤其是VMC发展的绝对看好,我爱我家Ringo置业团队郑重向我们的客户镇重承诺,您置业,我包底;入伙前;不论房价是涨是跌,只要提出申请,我们都以签订合同价回购原售物业。贷款买房的您、再也不用担心租金下降,无力还贷;投资买房的您,再也不用纠结所购之房是否会升值、能否有回报。有了这种武装到牙齿的保证,您还在犹豫什么?一句话,想投资 会理财 从此你不再是小白,你置业 找Ringo 永远不会是空着手!低風險,穩見回報现金流,轻松赚。您也许会问,为什么我们敢包底,那是因为你还不了解旺市,不知道这块土地“旺”在哪里。根据最新的城市建设规划,以及主要地产商的新推楼盘选址,旺市可谓是一片大好光景。想寻求投资升值,或者家庭自住,旺市这片区域都值得好好了解。 Festival Condos,由Menkes倾力打造的豪华社区大盘,将乘着旺市都会中心的发展势头,于今年第二季度推出。Festival 位于Hwy 7和Interchange Way的交界处,处在旺市都会中心南的核心位置。项目规划建设4栋高层公寓,共计住宅单位约1800个。首推公寓将为二栋,推出涵盖1房到3房多种户型,起价仅40多万。这将是旺市罕见的超大规划生活社区,就好比该地区的一只潜力股,一手投入极具升值潜力。 楼盘名称:Festival Condos开发商:Menkes…